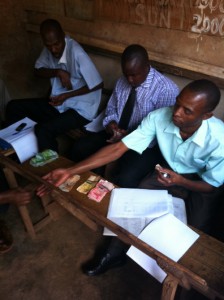

An Outstanding Group of Ugandan Microfinance Clients

These people meet weekly in this very, very rough setting to repay their loans. They must each be current on their payments for the group to be deemed current. They all are. On their own (not an idea from the bank) over the past few years this informal group has established a “reserve fund.” The fund is now “over reserved” so as a group they are buying a motor scooter and hiring a driver to start a taxi service owned by the group.

Amazing. I am just blown away. They have done this on an average loan size of $80. As a group they now have a loan balance of $8,000.

Amazing. I am just blown away. They have done this on an average loan size of $80. As a group they now have a loan balance of $8,000.

Insight Trip traveler Kevin of Palo Alto, Calif. writes about a Trust Group of Opportunity Uganda clients thinking creatively to further improve their futures. Kevin traveled with Opportunity supporters and staff last week to Rwanda and Uganda to see firsthand the impact of our Banking on Africa campaign.

Stay tuned to the Opportunity Blog for more from their exciting trip.