Publications Knowledge Exchange

The Challenges and Experiences of India’s Banking Agents and Opportunity’s Agent Training

Opportunity International, March 2024

Summary of market research to understand the challenges and experiences of India’s Banking Agents and Opportunity’s Agent Training.

Spotlight on EduFinance in Marginalized Communities

Opportunity International, March 2024

Opportunity's Education Finance program is adapting its approach to better serve marginalized communities like northern Ghana.

Pathways to Wellbeing Intro Brochure

Opportunity International, 2024

Description of Opportunity's innovative, holistic, values-based Pathways to Wellbeing training program, aimed at catalyzing client-owned pathways out of poverty.

Spotlight on Ultra-Poor Interventions

Opportunity International, January 2024

Opportunity supports multiple models for reaching and serving the Ultra Poor, the most entrenched group of people living in poverty.

Listening to Program Farmers

Opportunity International, October 2023

AgFinance, Opportunity Africa, and Knowledge Management team up for an intimate look at farmers in Western Uganda by capturing their stories.

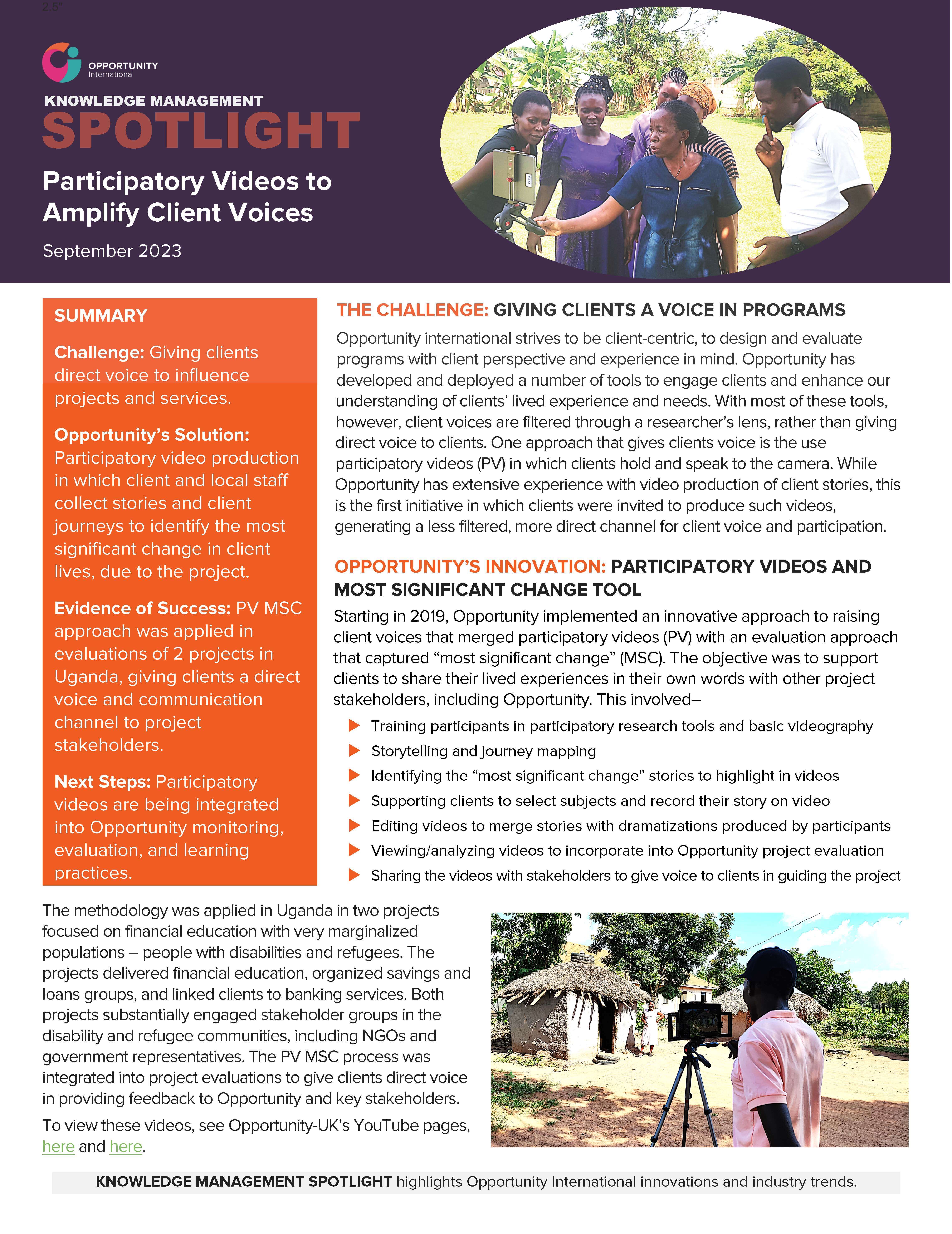

Spotlight on Client Voices

Opportunity International, September 2023

This brief of work-in-progress highlights efforts to raise the profile of client voices through participatory video production.

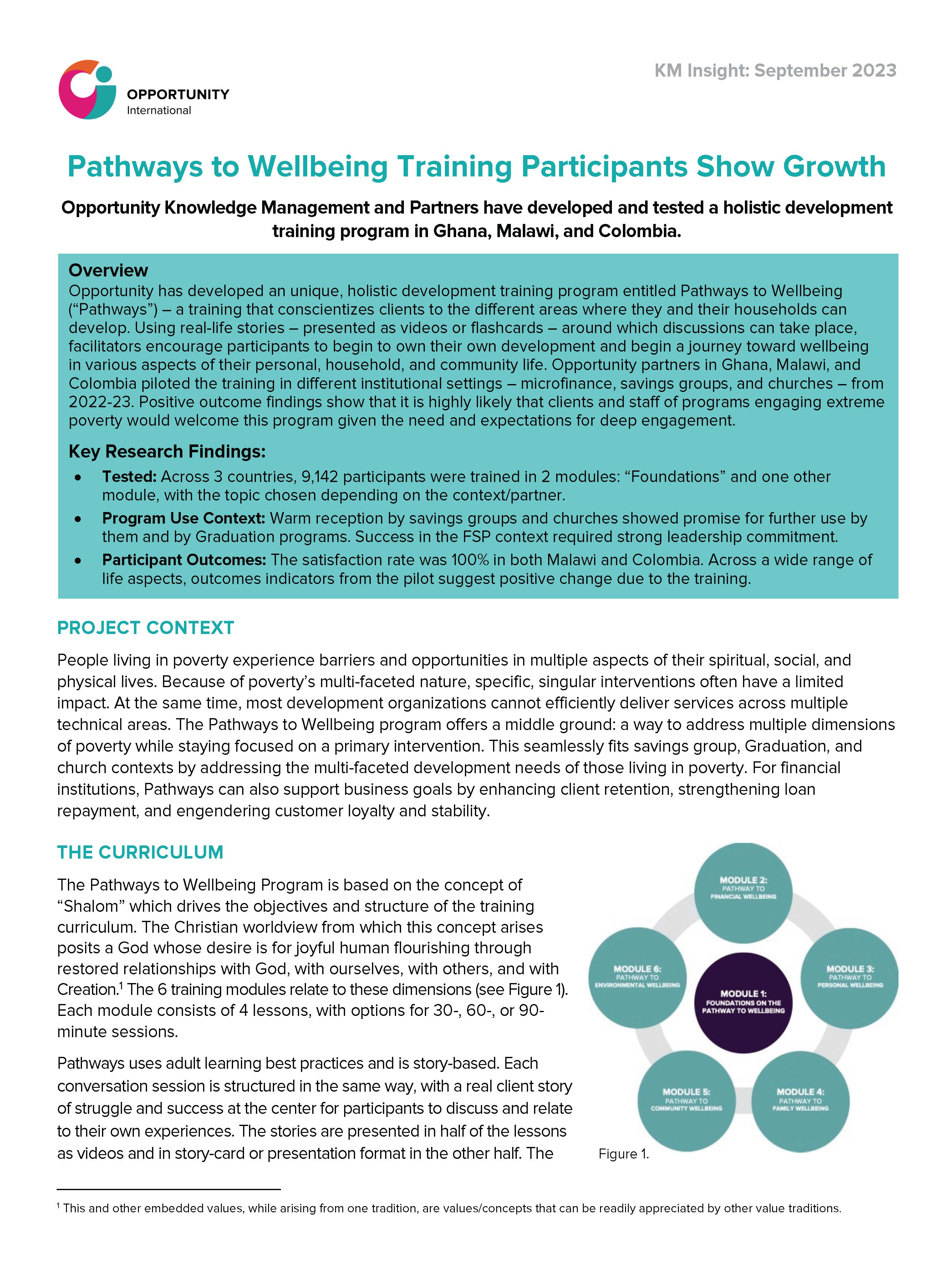

Pathways to Wellbeing Training Participants Show Growth

Opportunity International, September 2023

Opportunity has developed a unique, holistic development training program entitled Pathways to Wellbeing (“Pathways”) – a training that conscientizes clients to the different areas where they and their households can develop. Opportunity partners in Ghana, Malawi, and Colombia piloted the training in different institutional settings – microfinance, savings groups, and churches – from 2022-23.

Digitization of Savings Groups

Opportunity International, May 2023

This brief of work in progress summarizes Opportunity's digitization of savings groups in order to help them operate more efficiently and with fewer book-keeping errors.

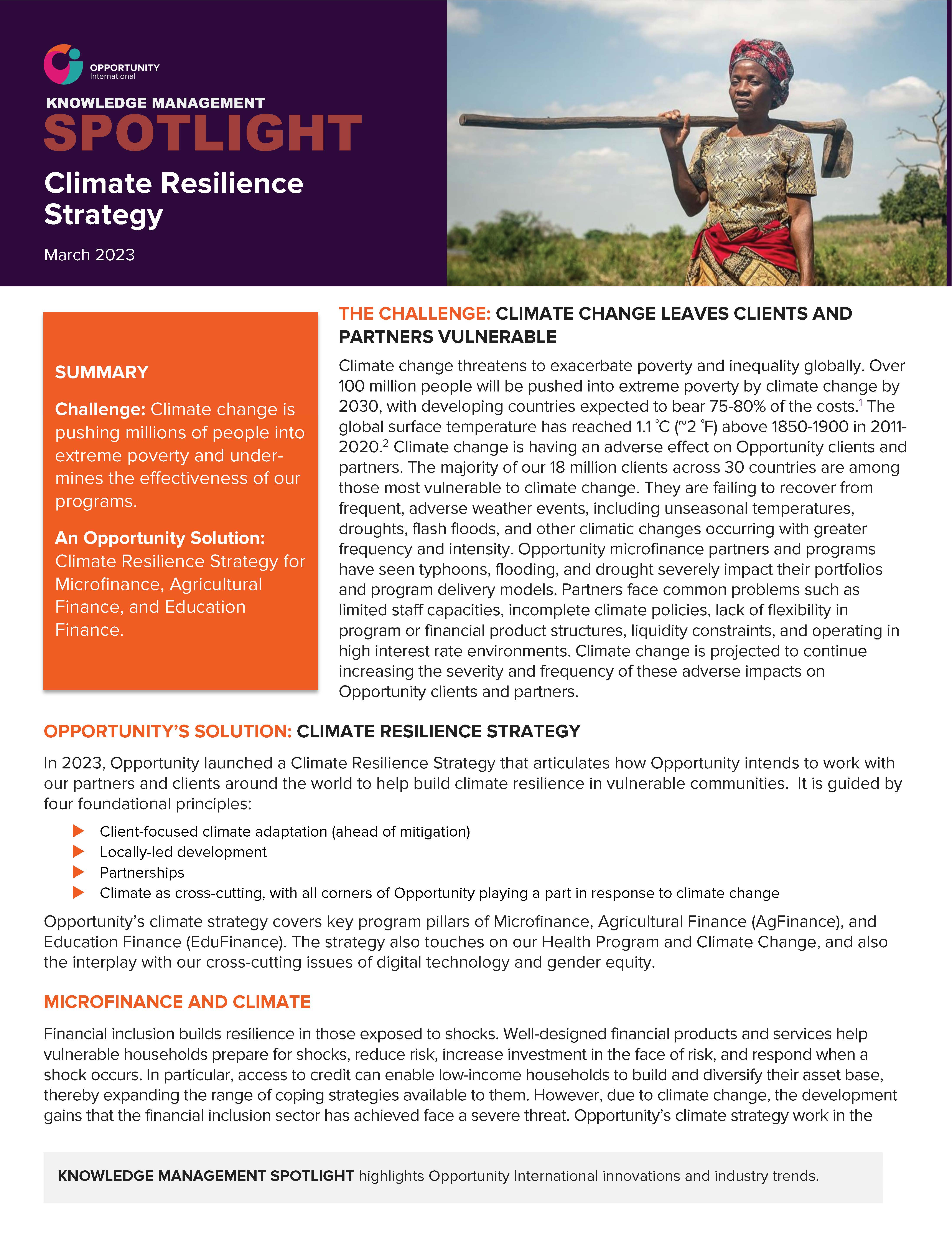

Spotlight on Climate

Opportunity International, March 2023

A summary of Opportunity's Climate Resilience Strategy.

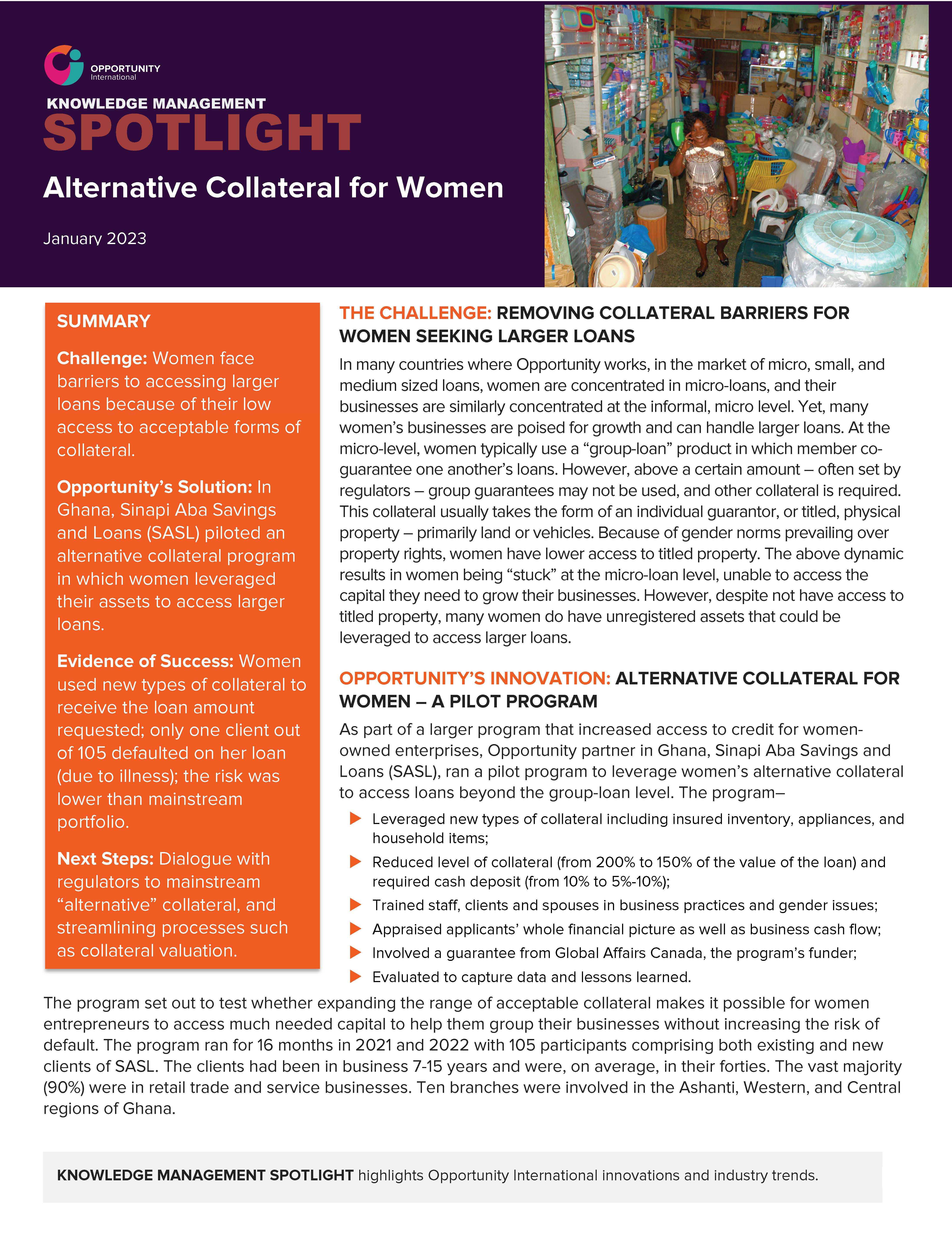

Alternative Collateral for Women

Opportunity International, January 2023

This brief of work-in-progress summarizes Opportunity’s efforts at helping women leverage alternative collateral to access larger loans, including next steps and challenges.

Serving People with Disabilities

Opportunity International, October 2022

This brief of work-in-progress summarizes Opportunity’s efforts in disability inclusion in Uganda, including next steps and challenges.

Community Health Care

Opportunity International, October 2022

This brief of work-in-progress summarizes Opportunity’s efforts in community-based health, including next steps and challenges.

Youth Economic Empowerment in Ghana and Uganda

Opportunity International, September 2022

This brief of work-in-progress summarizes Opportunity’s efforts in empowering youth, including next steps and challenges.

RISE Project drives Financial Inclusion among Refugees in Uganda

Opportunity International, August 2022

This brief of work-in-progress summarizes Opportunity’s efforts in serving refugees in Uganda, including next steps and challenges.

Ultra-Poor Graduation Programs

Opportunity International, July 2022

This brief of work-in-progress summarizes Opportunity’s efforts with economic graduation programs, including next steps and challenges.

Women's Empowerment Project Boosts Agricultural Production and Income

Opportunity International, May 2022

This brief of summarizes an Opportunity program to empower women in agriculture and agricultural finance.

Agricultural finance that reaches people facing poverty, gender, and age barriers

Enterprise Development & Microfinance Journal, March 2022

The March 2022 special edition theme is the potential for inclusive financial and market systems to reduce extreme poverty and improve food security.

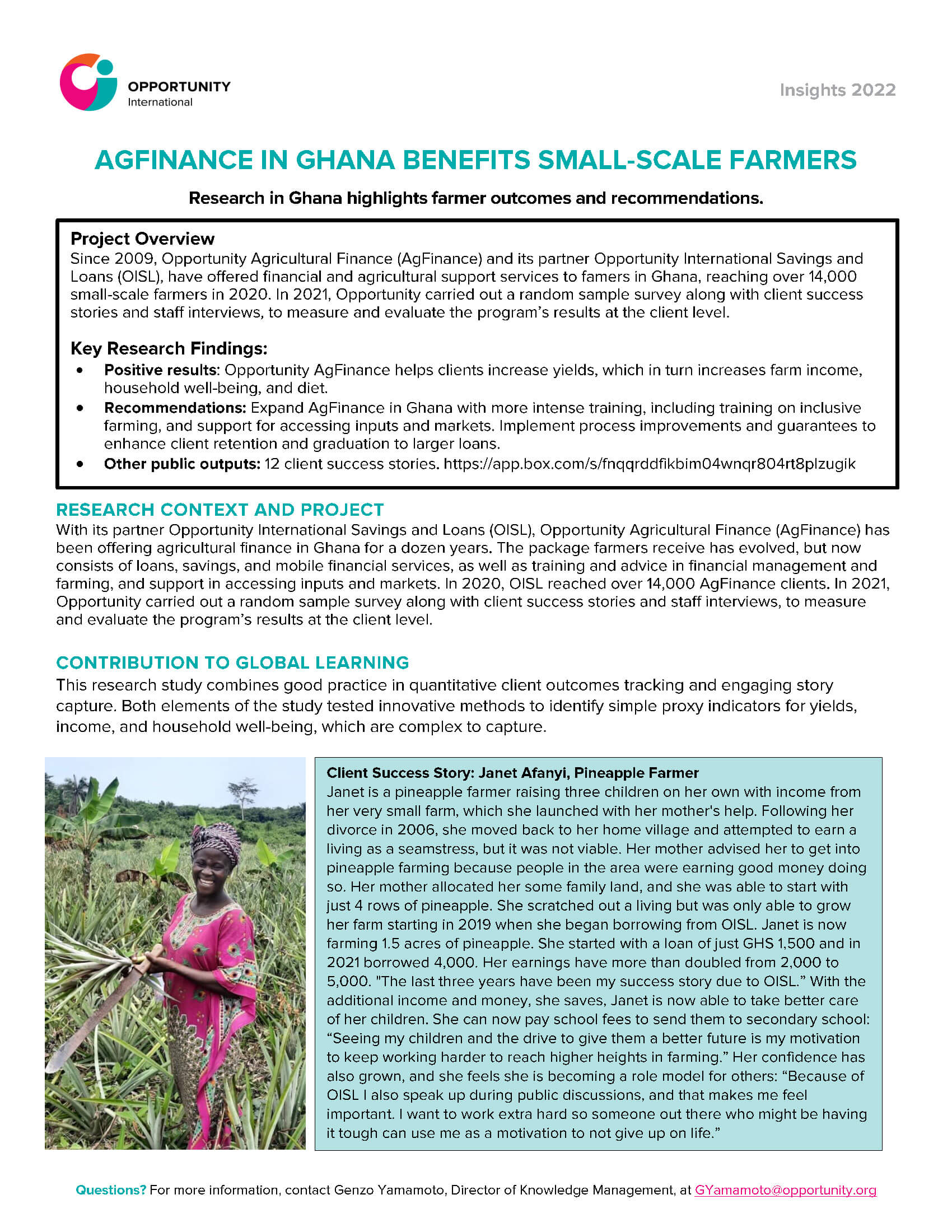

AgFinance in Ghana Benefits Small-Scale Farmers

Opportunity International, February 2022

This KM Insight summarizes results from a deep-dive evaluation of client-level results from one of Opportunity’s most mature AgFinance programs. The conclusion? Opportunity AgFinance helps clients increase yields, which in turn increases farm income, household well-being and diet. Detailed data is presented in infographics.

Knowledge Management Update - February 2022

Opportunity International, February 2022

Featuring work completed by the Knowledge Management team and our partners, this 2022 Update features evaluation results from SME finance and Agricultural Finance programs, discusses how Opportunity is reaching out to serve the extreme poor, and early results from our rigorous (RCT) impact assessment of “microfinance-plus” programming in three countries.

Agents of Empowerment - India - Digital Training Pilot Project

Opportunity International, January 2022

This issue is the first in our new publication series – Spotlights – focused on innovations and topics in international development pertinent to Opportunity’s work. In the featured pilot program, female agents in India are reaching out to women facing social barriers to using bank accounts and digital finance. Opportunity provides a training course and apprenticeships to prepare women for becoming government certified “Business Correspondents” (BCs). This women’s network has potential to financially empower millions or rural women.

Knowledge Management Update - October 2020

Opportunity International, October 2020

Nearly all KM projects are still underway despite the global pandemic. Most projects have been adjusted to account for new realities while others have been delayed. This section details what we are learning while adjusting to new realities.

RISE: Insights from Financial Diaries Baseline

Opportunity International, June 2020

Opportunity International U.K. (Opportunity) launched the Refugees: Innovation, Self-reliance & Empowerment (RISE) project in June 2019. The project addresses the main barriers to livelihood generation faced by refugee and host communities with a three-pronged approach: (1.) Design financial products for refugee and host communities to increase income earning potential and control over finances (2.) Equip refugees and hosts with financial skills to effectively manage household finances (3.) Provide loans and digital cash transfer options to stimulate merchant activity and enable refugees to purchase necessary goods—strengthening market linkages

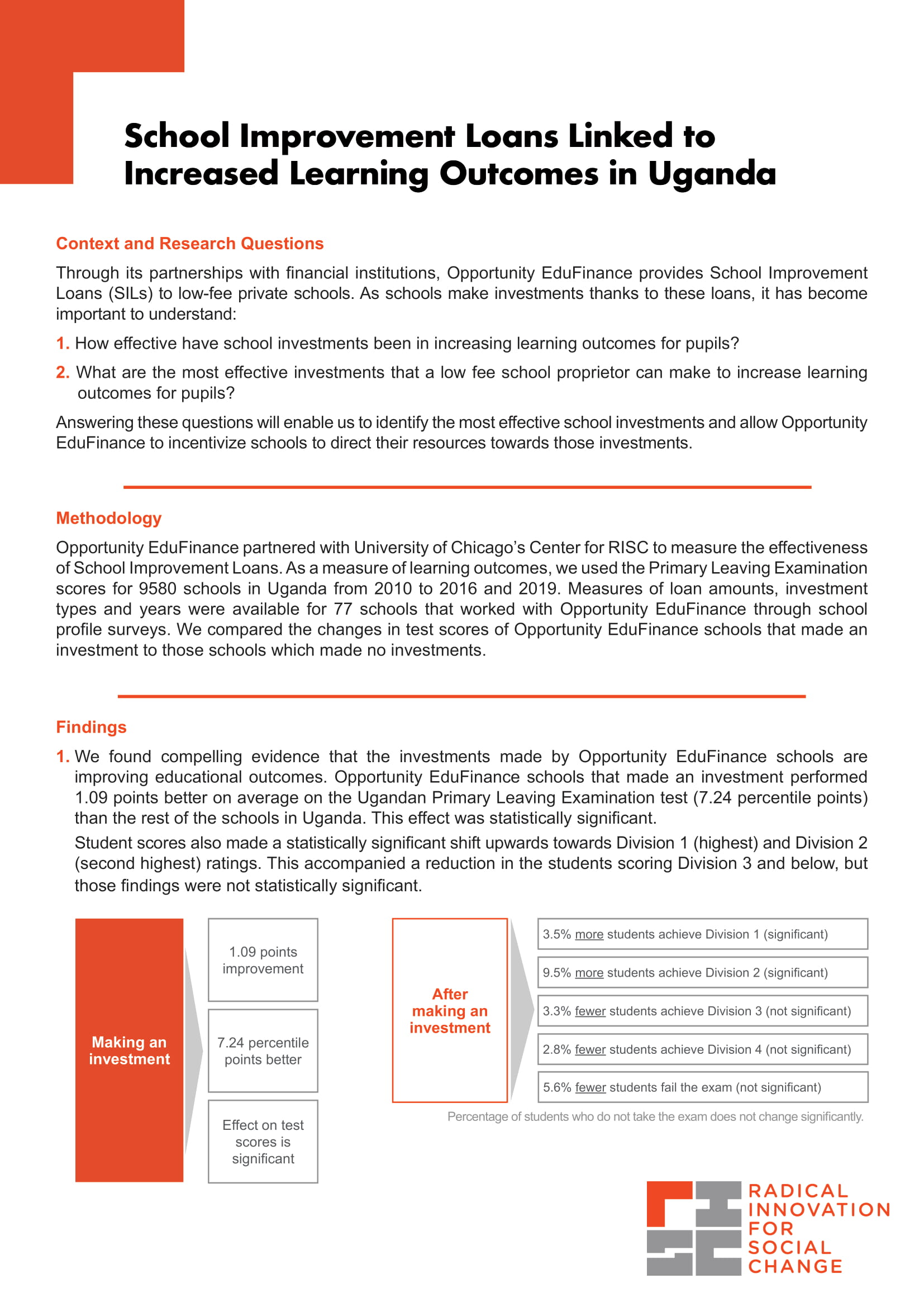

School Improvement Loans linked to increased learning outcomes in Uganda

University of Chicago's Center for RISC

Opportunity EduFinance partnered with University of Chicago’s Center for RISC to measure the effectiveness of School Improvement Loans in Uganda related to increasing learning outcomes for pupils.

Rise: Refugees and COVID-19: Impact on Food Prices, Consumption, and Distribution

Opportunity International, June 2020

As part of the Refugees, Innovations, Self-reliance and Empowerment (RISE) project, Opportunity is using financial diaries and other human-centered design approaches in order to make informed and appropriate investment decisions. In pre-COVID-19 interviews, 68% of the refugees interviewed were concerned about food price increases. When we repeated the interviews two weeks later, a week after lock down began, these fears were being realized, with 91% of respondents reporting an increase in food prices.

RISE: The Financial Lives of Refugees Living in Uganda

Opportunity International, June 2020

Opportunity International and its partners launched the Refugees, Innovations, Self-reliance and Empowerment (RISE) project in June 2019 to help integrate and financially include refugee and host communities, promote self-reliance among refugees, and stimulate local economic activity in refugee settlements and surrounding host communities. Opportunity gathered quantitative and qualitative data on refugees’ financial needs and behaviors using financial diaries and other human-centered design approaches in order to make informed and appropriate investment decisions.

Understanding School Fee Loans

Kantar Market Research & Opportunity EduFinance

Research study conducted by Kantar Market Research & Opportunity EduFinance in Nairobi, Kenya finds school fee loans decrease absenteeism rates

Interactive Digital Tool Encourages Clients to Save More

Opportunity International, April 2020

Opportunity International is helping people in Africa to experience the benefits of using digital technology to access financial services with innovative high-tech, high-touch solutions that generate high impact. Opportunity tested one such innovation in Ghana and Uganda between 2017 and 2019: Interactive Voice Response messaging (IVR). Recorded messages in local languages were sent out to clients to stimulate positive saving and borrowing behavior, improve financial literacy, and raise awareness of their rights as clients.

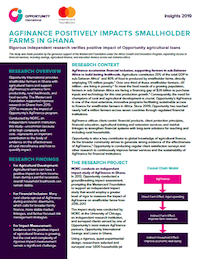

AgFinance Positively Impacts Smallholder Farms in Ghana

Opportunity International, November 2019

Opportunity International provides smallholder farmers in Ghana with agricultural loans and support (AgFinance) to enhance farm productivity, rural livelihoods, and food security. The Mastercard Foundation supported rigorous research in Ghana from 2015-2017 to measure the impact of Opportunity’s AgFinance program.

Success Factors for Digital Partnerships

Opportunity International, November 2019

Opportunity International, in partnership with the Mastercard Foundation, has implemented a number of digital tools to expand access to financial services for those living in rural, sub-Saharan Africa. In 2018, Opportunity International commissioned PHB Development to undertake a study aimed at shedding light on innovations taking place in the digital space in Uganda, with a focus on exploring digital partnerships and identifying best practice partnership factors. Over 100 partnerships were identified and representatives from 15 organizations were interviewed to create this list of six key success factors.

Knowledge Management November 2019 Update

Opportunity International, November 2019

Our November 2019 issue focuses on how ongoing research at Opportunity International is answering three, big picture questions: "Is Opportunity Measuring Impact?" "How is Opportunity Innovating?" and "How are Opportunity's programs getting stronger?"

Opportunity's Key Learnings: Women and Girls

Opportunity International, November 2019

Opportunity’s Key Learnings: Women and Girls shares a sample of evidence related to how Opportunity’s work has positively benefitted women and girls. This two-pager shows how research from across the network is helping Opportunity answer pressing questions like, “How do Opportunity’s women clients benefit from financial products and services? How is Opportunity identifying and addressing barriers faced by women in local economies? How is Opportunity supporting girls’ education and career pathways?”

Working with the Private Sector to Empower Women

AWEF and SEEP, August 2019

The Arab Women's Enterprise Fund (AWEF), in collaboration with the SEEP Network, featured Opportunity International's interactive voice messaging pilot in a practitioner learning brief. Opportunity’s work was featured alongside other reputable organizations such as World Vision, FINCA, Plan International, and more. The report is attached to this email (Opportunity International Savings and Loans Ghana is mentioned explicitly on pages 22 and 43)

Digital Client Engagement: Interactive Voice Response (IVR)

Opportunity International, July 2019

Digital technology has the potential to transform lives, to link people across vast geographic distances, and to open vast worlds of information, services, connections—but only if one has access. Opportunity International is helping people in Africa to experience the benefits of using digital technology to access financial services with innovative high-tech, high-touch solutions that generate high impact. Opportunity tested one such innovation in Ghana and Uganda between 2017 and 2019: Interactive Voice Response messaging (IVR).

Knowledge Management May 2019 Update

Opportunity International, May 2019

This issue of the semi-annual KM Update focuses on recent research that answers two main questions: “How is Opportunity’s work benefitting women in sub-Saharan Africa?” and “How is Opportunity improving as a learning organization?”

Examining Obstacles to Small Business Growth in Rural China

Opportunity International, April 2019

Despite monumental progress in reducing poverty levels in China over the past few decades, economic inequality—largely linked to access to employment and credit remains a serious concern. With support from the MetLife Foundation, this study seeks to gain a deeper understanding of the business goals, challenges, and conditions currently facing rural Chinese entrepreneurs. (Summary)

School Improvement Loans Linked to Positive Outcomes in Ghana and Uganda

Opportunity International, March 2019

In 2018 Opportunity partnered with Three Stones International to conduct a study to further understand the effectiveness of its School Improvement Loan product after multiple cycles by identifying dimensions of change and assessing the breadth and depth of programmatic impact on a sample of participating schools, students, parents and the wider community. The summary and full country reports are available for download.

Reevaluating What We Know About the Impact of Microfinance

Opportunity International, March 2019

A recent review of six studies on the impact of microfinance by economists at the University of Connecticut has determined that prior claims that these studies discredited the impact of microfinance were themselves unfounded. Instead, when the studies are aggregated to achieve greater power, the data suggests the possibility of the impact of microfinance being moderately positive for business profit and durable consumption outcomes. (Summary, Policy Note, and Full Report available for download.)

2018 Key Research Insights

Opportunity International, February 2019

In 2018, Knowledge Management (KM) conducted and supported research across 10 countries, strengthening programs and partners, identifying effective client pathways out of poverty, and testing innovations. The KM team also reviewed and summarized complex research from previous years for better use by program strategists and fundraisers. This two-pager shows how research from across the network is helping Opportunity answer pressing questions like, “How do we know that Opportunity’s work is impactful?” and “How can Opportunity better engage women as clients?”

Understanding the Chinese Client Experience

Opportunity International, January 2019

Despite monumental progress in reducing poverty levels in China over the past few decades, economic inequality—largely linked to access to employment and credit—remains a serious concern. With support from the MetLife Foundation, this study seeks to gain a deeper understanding of the business goals, challenges, and conditions currently facing rural Chinese entrepreneurs. (Full report)

KM Insight - Strengthening Education and Career Pathways for Women and Girls

Opportunity International, December 2018

Opportunity International tailors holistic financial empowerment to directly benefit women as clients and shape women’s and girls’ surrounding environment through services such as women-inclusive trainings, school loans, and professional development programs. In 2017, the Knowledge Management team conducted research to better understand the barriers and successes women and girls encounter along their pathway towards financial empowerment.

Knowledge Management Update - October 2018

Opportunity International, October 2018

The October 2018 KM Update touches on a number of recent research studies and activities, including the development of a new research approach to help organizations optimize their interventions, a rigorous impact study of smallholder farmers in Ghana, a refresh of the AgFinance program's gender strategy, findings from recent research on SME clients in Ghana and China, and an update on developmental evaluations of the EduQuality program in Uganda.

Empowering Women in Agriculture: Key Success Factors from Action-Research

Opportunity International, July 2018

This learning brief presents key success factors from an innovative initiative to sustainably deliver agricultural support to women farmers, helping them to benefit more equitably from commercial agricultural markets.

Education Finance: Key Programmatic Findings

Opportunity International, June 2018

Opportunity's EduFinance program fosters inclusive learning environments and opportunities for increased access to education by offering school proprietors, teachers, parents, and students a range of sustainable, scalable services. The following are some recent key learnings shaping the EduFinance program and demonstrating its positive benefits for financial institutions, communities, schools, families, and students.

Knowledge Management April 2018 Update

Opportunity International, April 2018

Our third issue touches on the following topics: (1) Findings and recommendations around the factors keeping girls and women from completing school and securing economically-viable jobs, such as an unclear understanding of the job market or requirements for how to acquire a job in a specific field. (2) An update on the Microfinance Plus Impact study, including economist Dr. Nathan Fiala’s recent work reviewing the six studies claiming rather mediocre impact results for microfinance. (3) Findings from multiple AgFinance project evaluations conducted in Ghana and Mozambique with a range of benefits reported by clients in increasing harvests, employment, and food security.

Understanding Girls' Education and Career Pathways in Context

Opportunity International, April 2018

To support the launch of the Women and Girls program, the KM team conducted research to better understand the diverse factors that keep girls and women from completing school and securing economically-viable jobs. This research drew from interviews with girls, women, and teachers from five countries across the Opportunity network (Colombia, Ghana, India, Malawi, and the Philippines).

Tangible Benefits Reported by AgFinance Clients

Opportunity International, April 2018

Opportunity launched its AgFinance program as a pilot in 2009 and has since become one of the largest and most innovative organizations facilitating access to finance for smallholder farmers in Africa. Between 2015 and 2017, Opportunity conducted five client surveys in Ghana and Mozambique. These studies generated evidence of benefits for AgFinance clients.

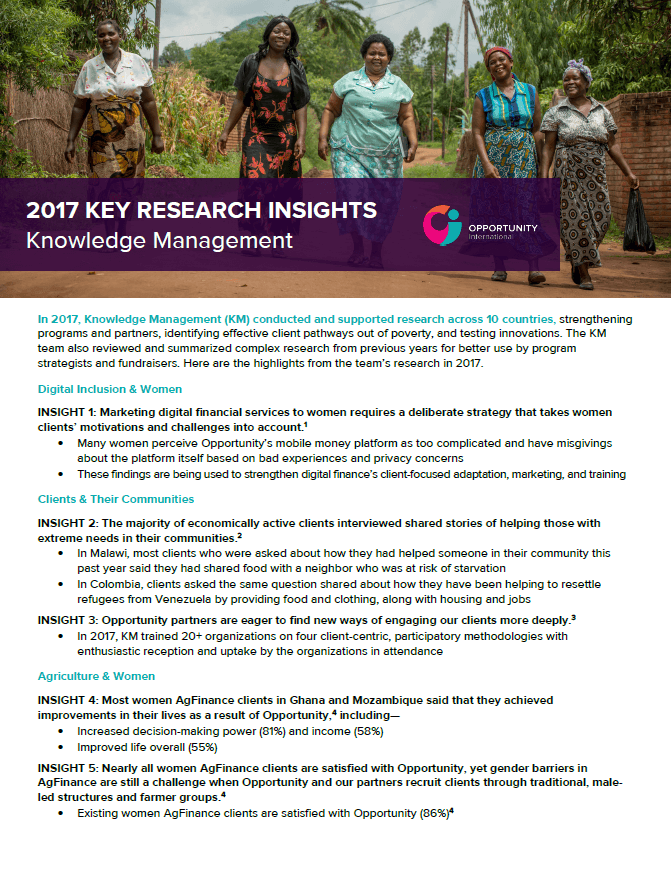

2017 Key Research Insights

Opportunity International, February 2018

In 2017, Knowledge Management (KM) conducted and supported research across 10 countries, strengthening programs and partners, identifying effective client pathways out of poverty, and testing innovations. The KM team also reviewed and summarized complex research from previous years for better use by program strategists and fundraisers. Here are the highlights from the team’s research in 2017.

Knowledge Management October Update

Opportunity International, October 2017

In the second half of 2017, Opportunity's KM team was hard at work - equipping partners to improve client understanding, enabling innovative action-learning for women in agriculture, planning a rigorous study to measure the impact of microfinance "plus," and more!

Opportunity Agricultural Finance: Value Chain Partnerships in Practice

Opportunity International, October 2016

Opportunity International’s Agricultural Finance model calls for Opportunity to reach scale and manage risk by targeting specific value chains and entering partnerships with businesses and organizations in these value chains. This research describes these value chain partnerships in practice and analyzes their effectiveness in order to improve performance and reduce risk while also generating insights for the broader agricultural finance community.

Understanding the Benefits of School Improvement Loans for Schools, Families, and Communities

Opportunity International, May 2017

At the core of EduFinance is a desire to make affordable, quality education accessible to children in developing countries by providing qualified, mission-driven school proprietors with financing and training. This research shows that through this combination, proprietors are equipped with the resources they need to address the factors low-income, low-education parents consider when selecting a school for their children – namely schooling that is close to home, affordable, safe, and high quality.

Gender Analysis of AgFinance in Ghana and Mozambique

Opportunity International, August 2017

Opportunity International’s (Opportunity’s) Agricultural Finance (AgFinance) program helps smallholder farmers increase farm productivity, financial stability, and food security to enhance quality of life. To assess and improve its gender strategy, Opportunity conducted an analysis of its AgFinance program in 2016 with funding from the British Government’s Department for International Development.

Increasing Access to Affordable, High Quality Education

Opportunity International, August 2017

Opportunity International has been providing Education Finance (EduFinance) series to low-cost private schools for the past ten years. Opportunity’s partnership with local schools in Uganda and Rwanda has helped expand education access for low-income families, finance improvements to school facilities, and improve the quality of education.

Client Journey Mapping as Applied by Sinapi Aba Savings and Loans

Opportunity International & UNCDF MicroLead, August 2017

Through UNCDF’s MicroLead programme, Opportunity International and Sinapi Aba Savings and Loans tested a dynamic approach to understanding and improving the client experience. With a more detailed understanding of the client experience, Sinapi managers are making immediate changes to improve client service – from enhanced information flow to eliminating fees on SMS transaction confirmation.

Sinapi Aba's Conversion from MFI to Savings and Loans

Opportunity International & UNCDF MicroLead, August 2017

In 2011, Ghana’s largest and arguably most successful microfinance institution, Sinapi Aba Trust (Opportunity network member), converted to a government-regulated Savings and Loans Company – Sinapi Aba Savings and Loans. To reach this objective, Sinapi undertook major change initiatives across the entire organization. This case study compiles the experiences and lessons of Sinapi from this journey – documenting the transformation of an NGO-MFI into a commercial entity while maintaining the original mission of SAT: transforming the lives of economically disadvantaged people.

Quality Education for All: A Systemic Approach to Educating Girls

Opportunity International, April 2017

Opportunity has helped just under 1.9 million children (nearly 1 million girls) in developing countries secure access to affordable, quality, education. Our comprehensive approach addresses the challenges girls face to receiving an education by equipping parents and schools with—financial capacity; school leadership with enhanced awareness and training; and students with financial literacy, vocational training, and mentorship.

Empowering Women through AgFinance in Mozambique

Opportunity International, March 2017

Opportunity is implementing an action research pilot in Mozambique to innovate ways of sustainably linking women farmers to agricultural services, markets, and finance. One year in, this action research initiative has engaged more than 800 rural women farmers in commercial agricultural transactions through microenterprise intermediaries known as Farm Business Advisors.

Opportunity Insights, A Knowledge Management Report

Opportunity International, February 2017

Opportunity’s KM team is responsible for generating, capturing and disseminating knowledge throughout the Opportunity network as a result of conducting rigorous, groundbreaking research on clients, markets, operations and innovations. When the KM team disseminates this knowledge, it helps optimize operations, strengthen program strategy, further client understanding and facilitate knowledge exchange within the network, the financial inclusion industry and the broader poverty alleviation community. Ultimately, this knowledge provides valuable insight for understanding how Opportunity can transform our clients’ lives.

Insights on AgFinance Operations and Impact

Opportunity International, November 2016

Agricultural finance is risky and expensive for both farmers and banks. Opportunity’s AgFinance model is designed to reduce risks and costs by partnering with institutions that complement Opportunity’s financial services with high-quality inputs, training and market access. What is Opportunity learning about how these partnerships work? What’s the impact on farmers?

Girls' Education Challenge Midpoint Impact Results

Opportunity International, October 2016

Opportunity’s EduFinance program expands the market for affordable, quality education by extending loans and other financial services to private school proprietors and families. But how does this gender-neutral approach contribute to meeting the global girls education challenge? This rigorous impact study concludes that financing schools and families significantly increased learning outcomes and enhanced girls’ access to secondary school education. The addition of girls’ support groups smooths the path even further.

Positively Impacting Women Clients in India

Opportunity International, October 2016

A rigorous impact assessment of clients from three of our partner microfinance institutions in India indicates that women clients significantly increased income and well-being compared to non-clients with similar demographics. This assessment also affirms that Opportunity has a strong poverty outreach in India, with the majority of clients (80-85%) at the three partners studied in India living below $2.50 per day.

Strategies to Stimulate Sustainable Client Savings

Opportunity International, September 2016

The financial inclusion community is experiencing a common challenge: many savings accounts, little savings, and disappointing financial results. This innovative research combined financial analysis and participatory client engagement to identify clients with more potential to save and devise bother operational and marketing solutions to stimulate more sustainable client savings.

Linking Rural Women's Savings and Loan Groups with Formal Financial Services - Case Study

Opportunity International and Visa Inc, September 2016

In 2015 Opportunity in Uganda launched a new financial inclusion service with funding from Visa to reach more remote villages. Linking rural savings associations to banks can offer rural women a secure savings option and a way to access larger business loans while maintaining the group solidarity that is vital for social transformation. Click "view" for full version and summaries.

Sinapi Aba's Client Journey Mapping - Detailed Insight into the Client Experience

UN Capital Development Fund, September 2016

In Ghana, Opportunity and Sinapi Aba Savings and Loans partnered to better understand client satisfaction and needs using Client Journey Mapping, a participatory research methodology that elaborated the client experience in detail. The research covered all aspects of Sinapi’s services to diverse clients, including Sinapi’s recently-launched savings services.

Opportunity International: Assessing impact in Malawi

Opportunity International, October 2013

This research summary shares the exciting results of an extensive research project Opportunity completed in collaboration with The Mastercard Foundation and other generous partners in 2013 to determine the impact of our agricultural finance initiative on smallholder farmers. The document provides key information on how impoverished farmers who received financing from our banks in Ghana, Uganda and Malawi increased their crop production, yields and market access and improved their quality of life in important areas including education, health care and food security.

Financial Solutions for Sending and Keeping All Children In School

Opportunity International, November 2014

Opportunity’s innovative education finance initiative brings targeted financial services into the field of education. It helps private-school proprietors create better schools. It equips low-income households to provide their children with better educational opportunities. Each service we provide through the education finance initiative helps break down the main obstacles to education in poor communities.

Financing Smallholder Farmers to Increase Incomes and Transform Lives In Rural Communities

Opportunity International, June 2014

Opportunity is dedicated to equipping Africa's small-scale farmers with the tools they need to reduce hunger and food insecurity within their communities while also meeting growing worldwide food demand.

Agricultural Finance Impact Assessment

In October 2009, Opportunity International obtained funding from the Bill and Melinda Gates Foundation and The Mastercard Foundation for a bold new experiment in Agricultural Development Financing.

Social Performance Management Report - 2013

Since 2012 we have been instituting Social Performance Management (SPM) as part of our new strategic plan. We are at the vanguard of the industry in utilizing SPM to measure how to achieve social goals and identify areas where we can improve the social outcomes for our clients. Through SPM, we are expanding our collection of data on who we serve and how their lives are changing. That data is then analyzed to assess how well we are aligned in our mission and how we can perform even better.

Interim Social Performance Report

Opportunity International

Since 2012 we have been instituting Social Performance Management (SPM) as part of our new strategic plan. We are at the vanguard of the industry in utilizing SPM to measure how to achieve social goals and identify areas where we can improve the social outcomes for our clients. Through SPM, we are expanding our collection of data on who we serve and how their lives are changing. That data is then analyzed to assess how well we are aligned in our mission and how we can perform even better.

Assessing the Impact of Opportunity International’s Agricultural Lending Program

Opportunity International, October 2013

This research summary shares the exciting results of an extensive research project Opportunity completed in collaboration with The Mastercard Foundation and other generous partners in 2013 to determine the impact of our agricultural finance initiative on smallholder farmers. The document provides key information on how impoverished farmers who received financing from our banks in Ghana, Uganda and Malawi increased their crop production, yields and market access and improved their quality of life in important areas including education, health care and food security.

Internal Operational Challenges Around Rural and Agricultural Finance

Opportunity International, May 2012

This “FIELD Brief” is the seventeenth in a series produced by the Financial Integration, Economic Leveraging and Broad-Based Dissemination (FIELD)-Support LWA Program. This brief discusses the internal operational challenges posed when implementing rural and agricultural finance.

Agricultural Finance - The Opportunity Difference

Learn how Opportunity International’s agricultural finance initiative equips farmers with the services they need to move from subsistence to economically and commercially active farming, thus increasing household incomes and food security throughout Africa.

2011 Sub-Saharan Africa Regional Snapshot

MIX Market and CGAP, February 2012

This analysis of microfinance and key trends in sub-Saharan Africa for 2011 highlights the impact of mobile banking in the world’s most unbanked region. The data covers approximately 23,000 providers of deposit, credit or mobile banking services in all 45 countries in the sub-Saharan region where less than 12% of people have a bank account.

Microinsurance - A Powerful Safety Net

Opportunity International

This video presents how MicroEnsure is working with mobile phone companies and other partners in Africa and Asia to provide a safety net to the people in the developing world.

Agricultural Finance - Cultivating Hope

This video presents Opportunity International’s approach to providing small-scale African farmers with comprehensive financial tools that help them increase yields, increase family incomes, and feed their villages.

Assessing the Impact of Our Microfinance Services

Over the last decade, Opportunity has conducted more than 50,000 face-to-face surveys with clients in Africa, Asia, Eastern Europe and Latin America.

Branchless Banking and Rural Outreach in Malawi: Opportunity International Bank of Malawi’s Impact on the Market

This study of the impact of technology-driven, low-cost rural service delivery system that Opportunity International Bank of Malawi (OIBM) pioneered in 2005, examines the value proposition of the bank-on-wheels concept for clients in rural and peri-urban areas.

Assessment of Household Saving Behavior and Access to Financial Services in Malawi

This report presents findings from research on household saving behavior and access to finance services in Malawi, looking particularly at income sources and levels and its relationship to savings behavior.

The Case for Support: Bringing Opportunity to Women

Opportunity International

Women represent an estimated 70% of those living on less than $2 a day. They suffer most from the chronic effects of poor nutrition, insufficient access to healthcare and limited educational opportunities. And they comprise the majority of victims of forced labor, gender violence, and legal and cultural inequities.

Microfinance and Gender: Some findings from the financial diaries in Malawi

This study presents research on the financial behaviors of hundreds of low-income Malawians to present the gendered characteristics of the Malawian economy and the impact of financial services on women.

Cash In, Cash Out: Financial transactions and access to finance in Malawi

This study reports findings from the research on 172 low-income households and the value proposition of financial services to its clients: the uses of the mobile van, impact on family cash flows, and the gendered implications of services.

Addressing Capital Adequacy for MFIs: A risk management approach

This paper reviews key issues that MFIs should consider in determining how much capital is necessary in order to weather adverse business conditions and thrive, looking specifically at the relationship between risk and capital adequacy through the lens of risk management.

Overcoming Back-End Barriers: Opportunity International and bank switching solutions

This report describes Opportunity International’s efforts to use technology, specifically back-end switching systems, to enable its banks to achieve widespread outreach to rural microfinance clients.

Expanding Outreach in Malawi: OIBM’s efforts to launch a mobile phone banking program

This study explores the efforts of the Opportunity International Bank of Malawi to implement mobile banking (m-banking) for its microfinance customers.

Role of Microfinance in Asset-Building and Poverty Reduction: The Case of Sinapi Aba Trust

This report evaluated the extent to which Sinapi Aba Trust contributed to poverty reduction among rural and urban poor especially women by supporting them with small loans to expand their businesses to build their asset base.

Developing a Cost-Benefit Analysis Tool: Experiences and Lessons from Malawi and Mozambique

This case study shares the experience of Opportunity International in designing a cost-benefit analysis tool to evaluate and compare microfinance delivery channels. It chronicles the tool’s design and analysis features, the challenges faced, and offers practical experience to other microfinance institutions looking to design similar tools.

Rural Manual

This manual presents a compilation of articles discussing topics relevant to reaching the rural poor with financial services: agricultural finance, microinsurance, m-banking, back-end barriers, cost-benefit analysis, and rollout approaches.

Banking Rollout Approaches to Rural Markets: Opportunity International Bank of Malawi

Opportunity International

This paper examines strategies for expanding microfinance bank operations to a rural setting based on the experience of Opportunity International Bank of Malawi (OIBM), looking specifically at client responsive product modification, marketing/education, technology and distribution channels, and rollout.

.jpg)

.png)