Understanding the Needs of Farmers in Kyenjojo, Uganda

Microfinance is more than just loans and savings and business—it’s a way forward for many families with few resources and little hope. Wherever we work, we strive to understand the local communities and to get to know the families who use our resources. This is my third in a six-part blog series that explores how we serve the families of Kyenjojo, Uganda.

The Kyenjojo area is agriculturally diverse with crops such as tea, coffee, bananas, pineapples, cassava, sweet potatoes, maize and many others. Many of these are dietary staples for the community. A small portion of cassava or sweet potato with some water is a common meal for those struggling to survive on $1 to $2 per day.

Farmers of all crops face great challenges, including supply chain unreliability, natural disaster, drought, crop disease, restrictive seasonal income and soil nutrient depletion. With farmers’ livelihoods at the mercy of so many factors outside of their control, it is all the more important that they have access to important financial resources that give them the flexibility to save and to repay loans when crop yields generate a seasonal income.

Farmers of all crops face great challenges, including supply chain unreliability, natural disaster, drought, crop disease, restrictive seasonal income and soil nutrient depletion. With farmers’ livelihoods at the mercy of so many factors outside of their control, it is all the more important that they have access to important financial resources that give them the flexibility to save and to repay loans when crop yields generate a seasonal income.

The seasonality of farmers’ incomes is a particular concern for many rural Ugandans. Because crops require a long period for growth, gestation, harvest and, finally, transit to markets to be sold, farmers often have long periods in which they do not have reliable income. For this reason, resources such as savings, agricultural microloans and weather-indexed crop insurance that are tailored to meet the needs of farmers are especially critical. These resources make it possible for farmers with limited financial resources and uneven cash payouts to bridge lean seasons and afford critical resources such as crop inputs or school fees for children.

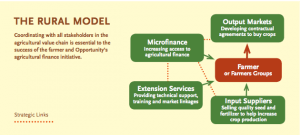

Even before the Kyenjojo branch opened, Opportunity Uganda staff were busy learning about and meeting with local farmers and farming associations to determine how the bank can best meet the financial and training needs of these groups. Farming associations pool the resources of the whole farming community–including input providers, animal care professionals and farmers with varying levels of experience–who work together to improve one another’s crops. As association members continue to communicate their needs and experiences with one another, supply chains are strengthened and crop yields can increase due to better understanding of farming best practices. Because farmers’ success is critical to the food security and overall health of the entire community, Opportunity is working hard to determine needs in order to design financial resources and training that will equip them for the long term, and enable them to position their broader community for success as well.

Even before the Kyenjojo branch opened, Opportunity Uganda staff were busy learning about and meeting with local farmers and farming associations to determine how the bank can best meet the financial and training needs of these groups. Farming associations pool the resources of the whole farming community–including input providers, animal care professionals and farmers with varying levels of experience–who work together to improve one another’s crops. As association members continue to communicate their needs and experiences with one another, supply chains are strengthened and crop yields can increase due to better understanding of farming best practices. Because farmers’ success is critical to the food security and overall health of the entire community, Opportunity is working hard to determine needs in order to design financial resources and training that will equip them for the long term, and enable them to position their broader community for success as well.

Stay Tuned for Part 4: A New Branch in Kyenjojo, Uganda