When I first met my Opportunity loan officer, I had nothing. Now, I have truly become a provider, and I know my future is in God’s hands.”

Luz Maria Atencia, Food Vendor in Cartagena, Colombia

A Message from the Global CEO

"If you’re like me, you believe everyone has tremendous potential. But, unfortunately, not everyone has an opportunity to fulfill that potential. Together, we’ve made great strides in 2014 to change that."

Vicki Escarra

Global Chief Executive Officer

Opportunity International

Lives Transformed

Investing IN Impact

Luz Maria

Investment

Opportunity provided Luz Maria with a loan, business training and a savings account.

Strengthen Business

She applied her training to make strategic business decisions, such as buying new kitchen equipment for her small food operation. With an updated kitchen in place, Luz Maria was able to make a better product in higher quantities, which boosted her sales.

- Personal income stabilizes

- Pride and hope increases

- Family is supported

Expansion

To help meet the increased customer demand, Luz Maria hired 4 neighbors to begin delivering food to the community. The increased exposure once again lifted her sales, and the business is now a hot spot in the neighborhood.

- Jobs are created

- More children go to school

- Futures are secured

Community Impact

Her employees can now provide for their families, which means Luz Maria has already impacted 20 lives...and the cycle won’t stop there. Opportunity communities go on to see schools expand, healthcare improve, new businesses appear, and increases in economic development.

The ultimate return on our investment is not measured in dollars, but in lives changed.

To read more about the many ways Opportunity International transforms lives, go to opportunity.org/spm

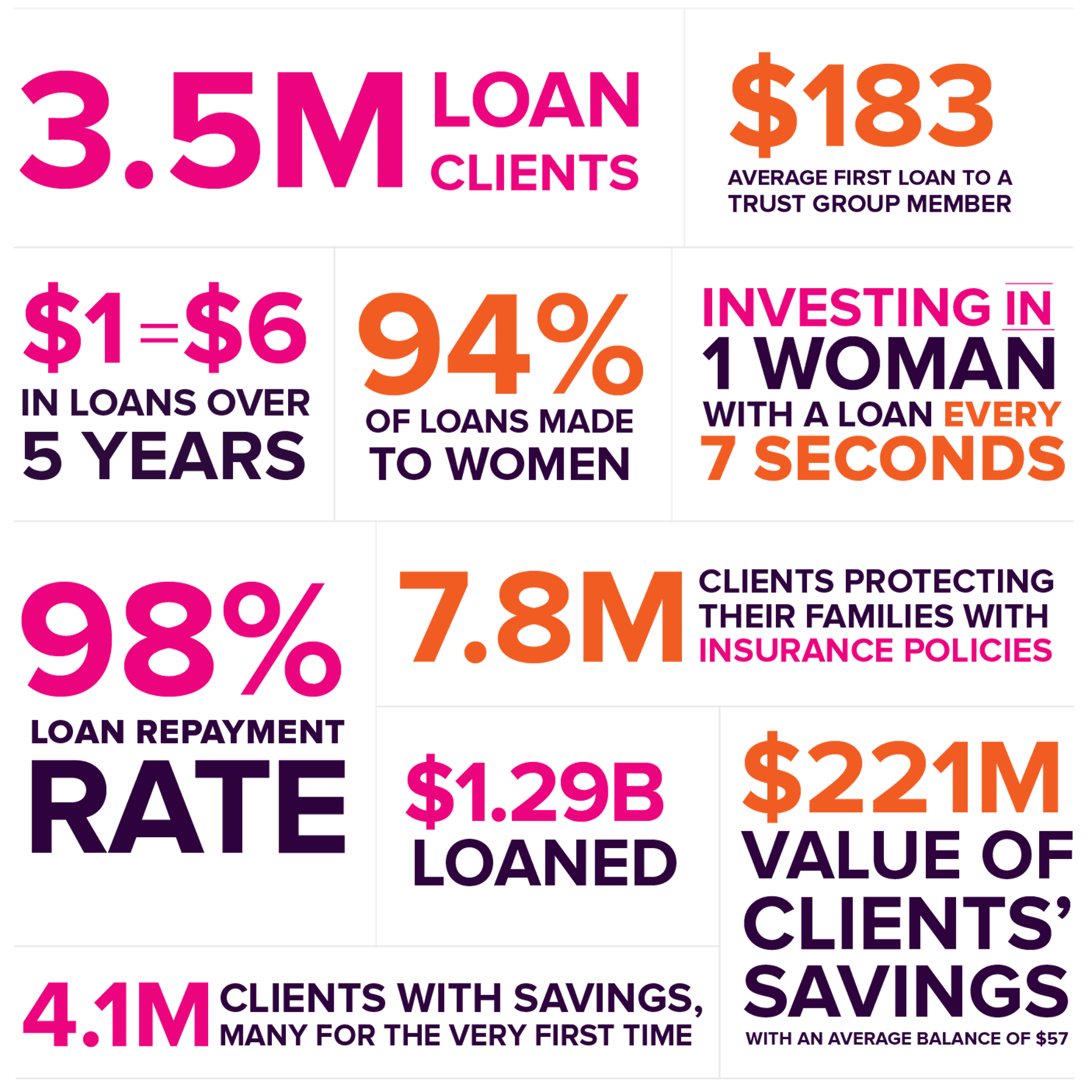

Opportunity in 2014

By The Numbers

The Impact of

Investing IN Access

Few things hold as much power to transform lives as technology, especially for those living in rural, isolated communities. Without access to banking products and relevant training, millions of people remain tangled in a cycle of hardship. For many, traveling hours to a bank is a significant burden on their family and business. By deploying unique technologies that allow people to manage money from cell phones, tablets, ATMs and point-of-sale devices at retail locations, Opportunity is increasing the efficiency of our banks and empowering clients with improved services.

$14.2M

THROUGH 76K LOANS DISBURSED TO FARMERS IN GHANA, KENYA, MALAWI, MOZAMBIQUE, RWANDA, TANZANIA AND UGANDA

I love the mobile bank van—it is very important to me because I can save my money safely. Since I received my loan, my eyes are now opened. I understand the importance of saving to protect my family and to achieve my goals. I have new hope for my future; I feel like I’m part of a wider community. I thank God for my growing business. Already, I have been able to hire laborers and purchase high-quality fertilizer. I learned modern farming practices and doubled my soybean production. Today, my husband looks at me differently: with respect and pride.”

Isabelle Alberto, Farmer in Mozambique

Small-scale farmers in particular are benefitting from our technology solutions. With Opportunity’s support, farmers in sub-Saharan Africa are gaining access to important financial services, which help them to achieve higher yields. In 2014, Opportunity:

Provided rural families with accessible and secure banking options for the first time. Because cell-phone banking encourages the unbanked population to open savings accounts, we launched this service in six African countries. Nearly 250,000 clients can now securely access their accounts and financial services around the clock via cell phones.

Increased operational efficiencies by equipping loan officers with cloud technology to exchange information with the central database in real time.

Equipped more rural loan officers with mobile kits, which include tablets that enable staff to serve more clients in the field and in their villages. These tablets speed up the registration process, as well as help monitor crop progress with photos and geotags.

Designed new tools to meet farmers’ needs, including technology that captures data more accurately, helping staff better track and analyze client information.

More than

1.3K

Financial access points established in Sub-Saharan Africa

As a result, Opportunity is more responsive to client needs. And because many technology solutions are less expensive than building bank branches, we can afford to reach even more clients. By better serving our clients, farmers are producing bigger harvests and increasing their incomes. This self-sufficiency contributes to our broader goal of alleviating hunger and creating sustainable livelihoods.

The Impact of

Investing IN Knowledge

Five major barriers threaten children in poor communities from completing their schooling: cost, proximity, quality, applicability to employment and life-threatening disease and disabilities. Opportunity uses innovative financial tools to address each of these roadblocks. Through education-focused loans, savings and insurance, we ensure that parents can afford to send their children to school each term, empower educators to improve and grow local school facilities and protect children’s futures should their parents fall ill or pass away.

In addition to these proven and successful initiatives, we continually seek to better address the challenges faced by students around the world. This year, two of our field partners and banks piloted a Youth Financial Education program to target marginalized students as they transition into secondary school, when dropout rates are highest.

700K

Children Impacted Through Education Finance Program

.jpg)

In the past, I didn’t take my education seriously— spending my pocket money on treats and skipping class. Then, I learned what I could do if I saved money. I learned to grow and sell vegetables to take the pressure off my struggling parents. I was so proud to save enough money to buy my own pen, and now I am saving to buy my own books.”

Maureen Alinaiswe (right), Student at the Nuvila Primary School in Uganda, pictured with Head Teacher Stella Nakato (left)

The program’s interdisciplinary approach educates youth on social enterprise, basic money management and saving for their futures. One of the program’s central goals is to highlight that continued education is vital for children to achieve their dreams. Emphasizing educational relevance is critical to ensuring children will stay in school. If a vulnerable family cannot clearly envision how a formal education contributes to the long-term growth and success of their child, at some point they will simply stop sending the child to school—and often, send him or her directly into the workforce. Similarly, if a school’s curriculum is not relevant to local economic and social realities, then a child’s classroom time will have less relevance to her or his future.

44K

Active child and youth savings accounts

In this second year of the pilot, it has been especially exciting to discover the ripple effect of parents learning from their children. In fact, parents say they are now paying closer attention to their finances, leading them to reduce bills, set aside money and waste fewer resources. Entire families are beginning to see the connection between education and prosperity. These encouraging results are a sign of the program’s potential success in many other communities.

The Impact of

Investing IN Innovation

In our four decades of microfinance work, Opportunity has continually evolved and innovated. We do this by working collaboratively with other organizations who share our goal of ending extreme poverty, and above all else, by listening to our clients. Every community has an abundance of talents, skills and passions that can be mobilized to tackle the many chronic issues related to poverty. Together, we work to define solutions from the inside out, always refining our approach.

290K

Families in India trained by community health facilitators

Years ago, I took out an Opportunity loan to buy buffalo for my farm. Though I grew my farm over time, my family was plagued by illness, and the high costs of medication hurt our ability to thrive. It was then that I joined the health training program and learned how important a clean toilet and sanitation is for preventing sickness. Afterward, I conducted a survey of my community to identify key health issues and spent six months teaching hundreds of mothers and daughters how they can stay healthy too.”

Nisha Devi, Community Health Facilitator in India

Responding to clients’ expressed needs means evolving our loans, savings and insurance products, as well as innovating new products, delivery systems and partnership approaches. These investments leverage the hard work and ingenuity taking place at the grassroots level by our clients. Some remarkable examples of innovation happening around the world with the help of our loans and services include:

Building water stations, irrigation systems and water filtration processes. For example, large groups of our farming clients in Nicaragua worked together to rehabilitate aqueducts and bring fresh and affordable water to 1,000 families for the first time—and also built in a sustainable payment system for the service.

Financing greener energy solutions such as solar panels, hydraulic power plants and energy-efficient ovens.

Improving well-being through health awareness programs and access to medical care. One program in India has Community Health Facilitators training hundreds of thousands of families on health and sanitation practices.

Training youth to run a business, manage finances and develop marketable trade skills to utilize when their schooling is complete.

6 Focus Areas for Innovation

- Agriculture

- Education

- Water/Sanitation

- Health

- Youth Entrepreneurship

- Alternative Energies

More than

1K

Families in Nicaragua getting fresh water thanks to their local farmers

Pilot projects like these allow us to partner with our clients to create solutions beyond microfinance. Opportunity is then able to test solutions before scaling up the most effective ones in other communities. Responding to complex needs identified by our clients is part of the creative problem solving that is helping to build businesses, stabilize livelihoods and enable our clients to begin their ascent from poverty.

The Impact of

Investing IN Security

Sometimes the path out of poverty does not require a loan but rather the security that comes with insurance protection or savings accounts. For many hardworking Opportunity clients, a single unforeseen event or disaster can quickly nullify their hard work and progress. For this reason, Opportunity offers products and services that form a crucial safety net to protect clients and their families. By visiting clients in their markets, farms and villages, we deliver appropriate solutions to address the particular risks they face.

10.3M

Lives protected by 7.8M insurance policies

To support my family, I sell ice cream made from coconut, lime, mango—whatever fruit is in season. Since I expanded my business, I have employed four rickshaw drivers who sell my products in neighboring villages. Today, I am saving my money to invest in my home…something I learned from my Trust Group. So far, I have made repairs to make my front porch safe. God is good—I am achieving my dream to finish my home, little by little. If you never start, you will not attain.”

Francisca Gongora, Food Vendor in Colombia

In 2002, Opportunity launched MicroEnsure to serve low-income households with the highest level of risk and the most limited access to insurance. Our suite of more than 200 custom health and multi-risk insurance products in Africa and Asia protects against death, health problems, credit challenges, political violence and crop failure. After Opportunity brought additional investors to MicroEnsure in 2013, the company expanded its reach in 2014 to serve millions of new insurance clients. We are thrilled that our continued partnership with MicroEnsure has allowed the Opportunity network to flourish exponentially across the globe.

We applied this same creative approach to our savings products. Among those living in poverty, the demand for savings can be up to seven times greater than the demand for credit. Without a formal way to safeguard earnings, people can become trapped. Opportunity’s savings products serve multiple needs: some are geared toward a variety of client types while others allow very small minimum balances. In 2014, we helped millions of people living in extreme poverty save for the first time.

2M

New women accessed savings accounts in India

The benefit of these insurance and savings products extends beyond the individual. Studies show that those who save are more likely to help their neighbors. This points to the transformational power of the Opportunity approach: empowered with a personal sense of security and stability, individual clients are then better able to contribute to their community’s well-being.

Learn more about why MicroEnsure was named a Transformational Business at opportunity.org/media

The Impact of

Investing IN Partnerships

Opportunity clients have a deep desire and drive to create better futures for themselves. Our corporate and institutional partners build on this by investing in Opportunity’s proven initiatives around the world. With their invaluable support, we are able to drive sustainable change that empowers our clients, creates jobs and builds prosperity. Thank you!

Caterpillar

Foundation

For more than 20 years, the Caterpillar Foundation and Opportunity have partnered to provide access to financial services and training for people living in poverty in the most rural, remote areas around the world. Today, the results of this enduring collaboration are evident—smallholder farmers achieve increased earnings and improved crop yields; entrepreneurs expand their businesses and strengthen local economies; women empowered with savings accounts, insurance and financial training can afford the cost of education to keep their children in school. With Caterpillar’s steadfast support, we will expand impactful innovations designed to reduce poverty and transform the lives of more than 18.3 million people by 2017.

Credit Suisse

More than 530,000 children in Colombia, Kenya, Malawi, Rwanda, Uganda, Tanzania, India and the Philippines can now access a quality education thanks to Credit Suisse’s support of Opportunity’s education finance initiatives. School proprietors use school improvement loans to improve the quality, availability and affordability of education by adding classrooms, hiring qualified teachers and providing lunches. Parents use school fee loans and child savings accounts to cover tuition, books and supplies to keep kids in school even when family incomes fluctuate.

John Deere

John Deere and Opportunity have joined forces to focus on solutions to fight world hunger. Through the partnership, African farmers in underserved rural communities are achieving increased yields, productivity and household incomes through easy access to customized financial services. In Uganda, John Deere and Opportunity developed an innovative mechanization loan product to give farmers access to tractors and agricultural equipment that substantially improves their productivity, yields and access to markets, garnering higher income at harvest time.

The

Mastercard Foundation

Building on the success of our most recent four-year partnership with The Mastercard Foundation, we are partnering again to provide broader and more convenient financial access to more than 7 million people in Ghana, Malawi, Rwanda, Uganda and Tanzania. Together, we will increase financial access through low-cost branches and mobile banking, improve smallholder farmers’ income and food security by expanding financial services and help more children get the education they need by providing education finance tools that increase access to quality education.

Metlife

Foundation

MetLife’s investment in Opportunity is helping to improve livelihoods in Jiangsu Province, China, by providing vital financial tools and training to rural, low-income families. Through a three-year partnership, Opportunity and MetLife are ensuring that small business entrepreneurs receive business development services and financial literacy training to sustain business growth and job creation. As a result, hardworking entrepreneurs are operating thriving, sustainable businesses.

Visa

Smallholder farmers and low-income families in Eastern, Central and Western Uganda are accessing financial services through Opportunity Uganda thanks to the partnership with VISA. Together, we are helping to electronically link Village Savings and Loan Association members to formal financial services so they enhance their productivity, increase incomes and improve quality of life while contributing to local economic activity.

Strategic Partners

Those generously contributing to our efforts in the field with their invaluable services, goods and thought partnership.

- Baker and McKenzie, LLP

- BANCOLDEX

- Blue Orchard

- Boston Consulting Group

- Caterpillar Foundation

- Cisco System Foundation

- Citi Foundation

- Credit Suisse

- Dorsey and Whitney, LLP

- Environmental Systems Research Institute, Inc.

- European Fund for Southeast Europe (EFSE)

- Freeport-McMoRan, Inc.

- Google, Inc.

- Inter-American Development Bank

- John Deere

- Lundin Foundation

- Mars, Inc.

- The Mastercard Foundation

- Mayer Brown, LLP

- MetLife Foundation

- Microsoft

- MicroVest

- Monsanto

- Oikocredit

- Paramount Media Group

- PVblic Foundation

- ResponsAbility

- Seven Bar Foundation

- Symbiotics

- TechnoServe

- TripleJump

- UN Capital Development Fund (UNCDF)

- US Agency for International Development (USAID)

- The UPS Foundation

- VISA

Ambassadors Council

Members who are using their leadership and business skills to champion our cause, while also contributing significant financial support to help bring about life transformation across the globe.

- Chuck Ahlem

- David Allman

- Dennis and Denise Blankmeyer

- Jeannie Buckner

- Jeremy and Krista Carroll

- Richard Cope

- Kathy Drake, Co-Chair

- Jeffrey Germanotta

- John and Kathryn Hart

- Jerry Jensen

- Kris Kelso

- Richard McClure

- Ted Moser

- Fred Sasser

- Tom Skelton, Co-Chair

- Drew Smith

- Peter Thorrington

- Kim Yim

The Impact of

Investing IN Opportunity

Total Value of Client Loans Disbursed

(for the year)

Gross Loan Portfolio at December 31, 2014: $780M

Total Value of Clients Savings Accounts

(as of year-end)

These figures represent voluntary savings and do not include compulsory savings.

Total Number of Unique Loan and Savings Clients

(as of year-end)

The total number of unique loan and savings clients in the years 2012-2014 include clients from Dia Vikas, Opportunity’s partner in India.

Total Funds Raised by Opportunity International - U.S.

(for the year)

The ratio of fundraising and G&A expense to total funds raised remained steady at 15% in 2014 and 2013, reflecting the increased amounts of equity and debt that was raised for Implementing Members.

Total Expenditures by Opportunity International - U.S.

(for the year)

These charts show the portion of total expenditures related to Program Activities, and Fundraising and G&A Activities.

2014

$51.5M

$51.5M

2013

$36.7M

$36.7M

A Message from the Global Board Chair

Mark Thompson,

Global Board Chair

Dear Friends:

“The bottom line, in my experience, is always to remember this is the Lord’s business. We are the ones He has chosen to carry it out…That is how it started. That is how it blossomed.”

These inspiring words from Opportunity International founder Al Whittaker still guide and drive our work today, 44 years later.

Together with our donors and other supporters, I consider it a great privilege to serve this organization and its clients. We took a number of important steps in 2014 to strengthen the organization and ensure the progress of our clients. Among the highlights, we formed the Opportunity International Global Board, which united our worldwide operations and staff and now guides the overall direction and strategies of the organization in the key areas of fundraising, budgeting, investment, branding and culture. Our new, centralized structure is helping us create a stronger organization and a more consistent and visible global brand that attracts a high level of support to improve and expand our services to even more clients in need around the world.

As you may know, we have set an ambitious goal to create and sustain 20 million jobs by 2020. By the end of last year, we had created 13.8 million jobs since our founding in 1971. That means we are nearly 70 percent of the way to achieving our goal. We are on a path to accomplishing something special, but there is still a lot of work to do. I have great faith in how far we can go.

This report details our progress and highlights how our innovative products, services and training are helping clients break the cycle of poverty and transform their lives. Going forward, we will remain keenly focused on nurturing smart growth, investing wisely and continuing to strengthen our commitment to helping our wonderful, determined and optimistic clients rise up to lead bigger, brighter lives free from poverty.

In Him,

Mark Thompson

Global Board

- Vicki Escarra Chief Executive Officer, Opportunity International

-

Dick Gochnauer

Acting Chief Marketing Officer United Stationers -

Stephen Harris

Principal Northern Beacher Christian School, Sydney -

Edward Kerr

Chairman, Opportunity Australia -

Robert Lawless

Chairman, Opportunity Canada -

Barbara Lupient

Chairman, Lupient Companies -

The Right Rev. Laurent Mbanda

Bishop, Anglican Church of Rwanda, Shyria Diocese -

Michael Ramsden

Regional Director, Ravi Zacharias International Ministries

-

Nils Ritterhoff

Chairman, Opportunity Germany -

Herve Sarteau

Former Senior Partner, CarVal Investors / Cargill, Inc. -

Beth Johnston Stephenson

Founding Partner, Willis Stein & Partners -

Mark A. Thompson

Chief Manager, Riverbridge Partners, LLC -

Peter Thorrington

Former President & COO, Uti Worldwide, Inc. -

David Tolmie

Partner, The Edgewater Funds -

Terry Watson

Chairman, Opportunity UK and MicroEnsure Holdings Ltd.

U.S. Board & Global Board Members as of July 2015

U.S Board

- Katéy Assem, Executive Director, Chicago State University Foundation

- Karen Robinson Cope, Executive Vice President, NanoLumens

- James W. Cox, Former Executive Vide President, Fiserv, Inc.

- Sandra Davis, Chair and Founder, MDA Leadership Consulting

- Vicki Escarra, Global Chief Executive Officer, Opportunity International

- Peter King AO, Former CEO, John Fairfax Group

- Mark Linsz, Former Treasurer, Bank of America

- Barbara Lupient, Chairman, Lupient Companies

- Richard McClure, Former President, UniGroup, Inc.(United Van Lines / Mayflower Transit)

- Jane Nelson, Former Vice President, Bank of America

- Elizabeth S. Perdue, Partner, Holland & Knight

- LeAnn Pederson Pope, Burke, Warren, MacKay & Serritella, P.C.

- Herve L. Sarteau, Former Senior Partner, CarVal Investors / Cargill Inc.

- Beth Johnston Stephenson, Founding Partner, Willis Stein & Partners

- Mark A. Thompson, Chief Manager, Riverbridge Partners, LLC

- Peter Thorrington, Former President & COO, UTi Worldwide, Inc.

- David M. Tolmie, Senior Partner, The Edgewater Funds

God has been so good in providing for me. As a single mother, I often struggled to pay for my five children to attend school—until Opportunity started a Trust Group in my village this year. It has been very good to be a part of the group. We support each other [by guaranteeing each other’s loans]. Our loan officer is wonderful, and all of our members share ideas, so we benefit from more than just a loan. I used my loan to buy high-quality seeds and fertilizer, and now I am profitable. I have built a house, sent my children to school and even hired someone to help me tend the land. I am so proud that I can now provide for my family."

Mary Makkazi (second from right), a Maize Farmer in Uganda, with members of her Trust Group and their loan officer (second from left)

Subscribe to our newsletter

When you sign up to receive email from Opportunity International, we'll keep you informed with updates, news and stories from our work around the world.

We respect your privacy. We will never sell, rent or exchange your email address with a third party.